Resources

If you're like most business owners, you want straightforward answers and trust worthy resources that can help you succeed. We can help! Choose from the links below to learn more, or schedule a free consultation to get started.

Funding Opportunities

Banks offer a variety of lending options that may be suitable for your business. Typically, most banks offer business credit cards, lines of credit, term loans, and US Small Business Administration (SBA) backed loans. Many banks will also offer commercial real estate loans and equipment loans.

Here are a few questions to answer before approaching a bank:

- How much money do you need, and why?

- Do you have a clear payment history and credit score over 600?

- How much collateral do you have to devote to the loan?

- What is your plan for success?

- Is your product or service market validated?

- How will your business cash flows cover the loan payment?

If you need help answering those questions, reach out to us. Click here to schedule a free consultation.

See Alternative Lending tab on this page to learn about alternative lending options.

If traditional banks are out of reach, consider alternative lending options like CDFI’s. Community Development Financial Institutions (CDFI’s) specialize in lending to individuals and businesses in under-resourced communities, typically offering clients financial education and a variety of specialized loan products that increase economic potential and help build wealth. Loan amounts tend to be smaller, though not always, and some CDFI’s even offer SBA products or grants.Consider CDFI’s if you:

- Don’t have a credit score over 550

- Don’t have collateral

- Want educational and technical support tied to loans

- Are seeking grant funds in addition to loan funds

Another option for raising funds for your business is crowdfunding. Crowdfunding is typically associated with charity, but many businesses use crowdfunding to raise cash quickly. This may involve tying contributions to early product releases or firm equity, but not always. Kickstarter and GoFundMe are popular examples.

Accelerate offers another type of crowdfunding called KIVA. KIVA is a crowdsourced lender, tapping local personal networks, and then global networks, to generate low interest loan funds for specific needs. KIVA currently offers loans to US small businesses up to $15,000 at 0% for a 36 month period. To learn more about how Accelerate can support your KIVA loan, click here to schedule a free consultation.

Private capital investments are typically available only to those businesses that demonstrate scalability, rapid growth, or obvious market innovation (or a combination of all three). Private equity firms typically look for established businesses that have a proven track record of profitability or profit potential, while venture capital firms typically look for market innovation or scalable technology. While PE firms usually take a majority stake in their acquisitions and control management decisions, VC firms usually take a hands-off approach. Angel investors are also an option, and Angels usually inject capital into new startups with a proven business model or product with the hope of a quick return on investment when the business sells - usually within 3-5 years.

If you believe private capital is the right step for your business, click here to schedule a free consultation. Keep in mind that private capital investors have a high standard, and this route may not be for you if you desire to maintain ownership for a long time.

To learn more about private capital, we recommend Pitchbook. Pitchbook is the industry standard for entrepreneurs looking to learn more about how to secure private capital. Click here to redirect to Pitchbook.

Another avenue for funding is by seeking out programs that offer grant awards or loans in conjunction with program completion. These opportunities come and go. We strongly recommend joining our newsletter, which regularly updates members on available grants and funding opportunities.

Here are a few examples of local programs tied to funding:

- Tarrant County College’s Everyday Entrepreneur Venture Fund

- PeopleFund’s BIPOC Accelerator

- The Center for Transforming Lives: Level Up program

Grants

Current Grants

Next Application Cycle in January 2024!

Who Does the Grant Help?

The Accelerate Small Business Accessability Grant supports small business owners, and their employees, with funds to offset or cover fees associated with accessibility, connectivity, and mobility, in advancing the business owner’s professional capacity, business awareness, regulatory compliance, or revenue potential.

How May I Use the Funds?

Funds may be used to offset or cover costs associated with eligible business expenses including, but not limited to:

- Chambers of commerce membership or event fees

- Certification for business training courses and related expenses

- Continuing education credits related to the business

- Financial literacy training

- Mentoring fees related to business ownership or operation

- Licensing or permitting fees applicable to the owner’s business

- Other

How Much Can I ask For?

Up to $500 total per submission per applicant. Individual businesses, and their assigns, are limited to $2,000 per year from the date of application. Additional award eligibility is not guaranteed.

When Can I Apply?

Application and awards are available on a quarterly cycle throughout the year. Be sure to subscribe to our emails and connect on our socials to receive updates and application announcements.

Do I Qualify?

- The applicant must be the owner of a small business registered in Texas

- The current primary business location must be within Tarrant County, TX

- The business must be a for-profit business. Non-profits are not eligible at this time

- The business must be less than 5 years old, as of the application date

- Previous calendar years’ gross revenues must be less than $250,000

- Recipient must be the business owner, officer or employee at time of funding

- Preference is given to business owners or employees who reside within, or to businesses located within, designated HUB Zones and Opportunity Zones within Tarrant County

- Preference is given to certified minority-, woman-, or veteran-owned businesses

- Qualified expenses include costs associated with business networking, continuing education, compliance, or startup costs

How Do I Apply?

- To apply for funding, applicants must complete the entry form for the grant program using Accelerate’s online form.

- Applicants will appear before the grant committee in-person, by video conference, or by video recording to submit a 5–10-minute statement of need, as determined by the Grant Committee. Applicants may be able to submit a 500 – 1,000 word written statement in lieu of appearing in person. Contact us for further information.

- Applications will be reviewed and considered on a first come, first served basis, based on need, eligibility, and available grant resources.

- Grant awards will be disbursed by ACH within 10 business days of grant approval. Bank accounts are required. Contact us if you need assistance.

Conditions:

- Awardees must accept the terms of the grant award prior to receiving funding, including use of the business’s name and logo for Accelerate’s marketing purposes, in addition to other requirements.

- Requests submitted for reimbursement of eligible expenses are given priority, and the expense date must be within 90 days of the date of agreement.

- If submitting for payment of future expenses, the applicant must demonstrate a financial constraint and submit additional documentation. Funding for future expenses will be considered on a case-by-case basis.

- Awardees agree to submit a written or video statement demonstrating the impact of funds within 90 days of funding. Failure to do so will result in disqualification for all future Foundation awards programs.

Exclusions:

- Non-profit organizations

- Marketing expenses

- Debt relief, personal credit reimbursement, or credit repair.

For more information, contact:

Accelerate Fort Worth Foundation

1150 S. Freeway, Bldg. 600

Fort Worth, TX 76104

info@acceleratedfw.org

817-201-7019

Do you have a small business grant opportunity to share with business owners?

Post it here!

To post an opportunity, please contact us at info@acceleratedfw.org.

Get Help

Click here to schedule a free consultation.

If you’re thinking about starting-up, scaling, or selling your business, we can help by working with you to sort through the noise, ask the right questions, and find the right resources for you.

Our mission is to connect entrepreneurs to the resources they need to develop, launch and grow. We do that by building business skills, creating accessible capital opportunities, and expanding professional networks, through person-to-person interaction.

While we may not know every answer, we probably know someone who does. And that’s at the heart of how we help entrepreneurs - people helping people.

You’re taking on all the risk, so let us help you navigate that uncertainty so you can stay focused on building a sustainable business.

To get help, call us or schedule a free consultation. Here are a few examples of how we can help:

- We answer “dumb questions” - this is a safe place for any question about your business!

- Coaching and mentoring

- Networking and connecting people

- Assisting with funding needs

- Business plan advising

- Technical assistance (classroom based learning)

The City of Fort Worth provides many resources for Small Business Owners. These include:

The City of Fort Worth also operates the Devoyd Jennings Business Assistance Center at the historic James Guinn School Campus, where Accelerate is located.

The BAC is home to 11 on-site collaborative partners, with a mission of promoting a strong economy by providing training, technical assistance, funding opportunities, and business support services to established, start-up small businesses and micro-enterprises. The BAC provides assistance on topics ranging from how to start a business or writing a business plan to becoming minority certified. Free one-on-one business counseling is available for all clients.

- Accelerate Fort Worth Foundation

- Alliance Lending

- FW Metropolitan Black Chamber of Commerce

- People Fund

- Regional Hispanic Contractors Assoc.

- SBDC

- SCORE

- South East Fort Worth, Inc.

- TechFW

- William Mann, Jr. CDC

Sparkyard connects a large network of primarily nonprofit service providers offering a wide variety of business-building services for small businesses. Sparkyard facilitates the linking of these resource organizations to one another and to established, emerging, startups, and small businesses throughout the region.

Sparkyard partners with numerous Resource Partners in Fort Worth, Tarrant County and beyond. Head over to the Resource Navigator for a comprehensive list of Resource Partners and the services they provided.

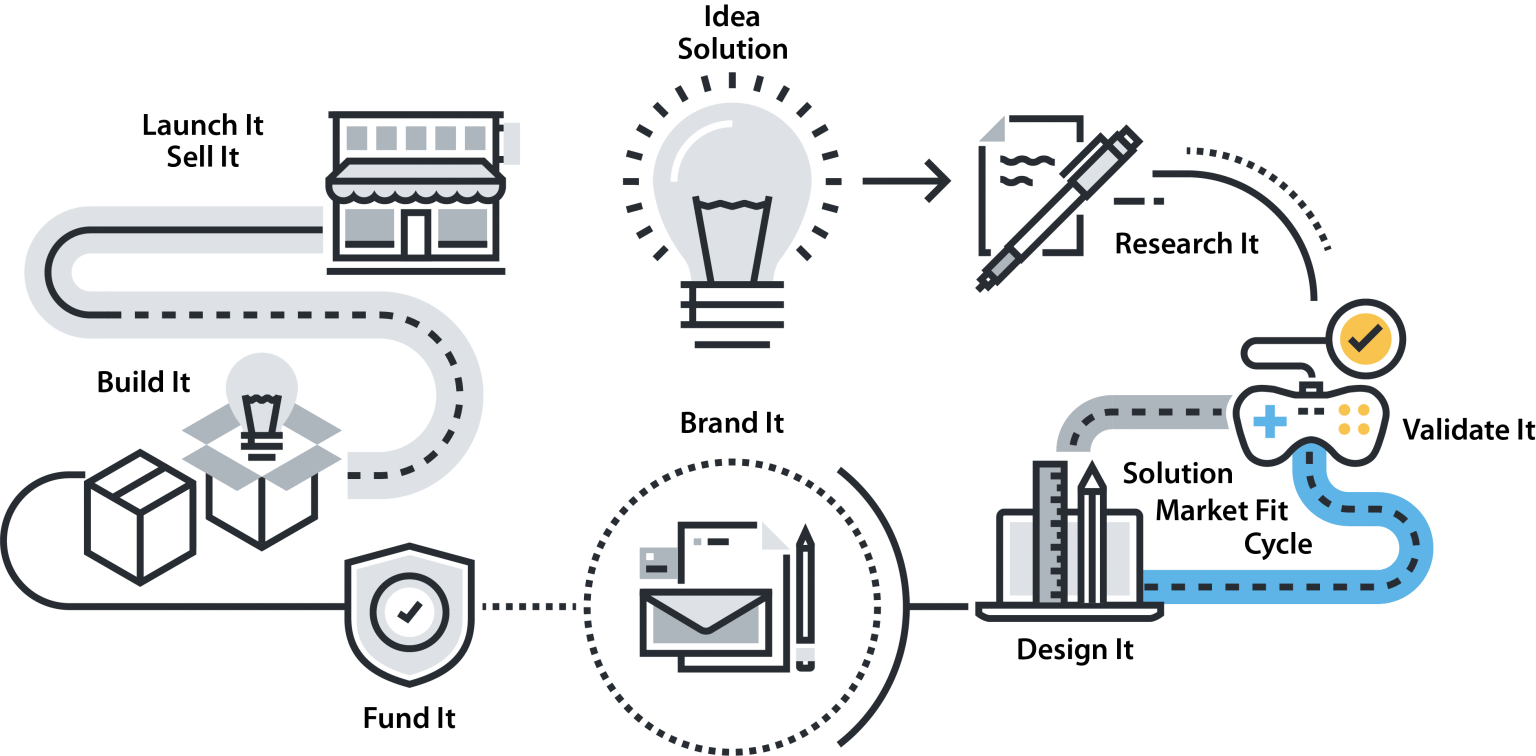

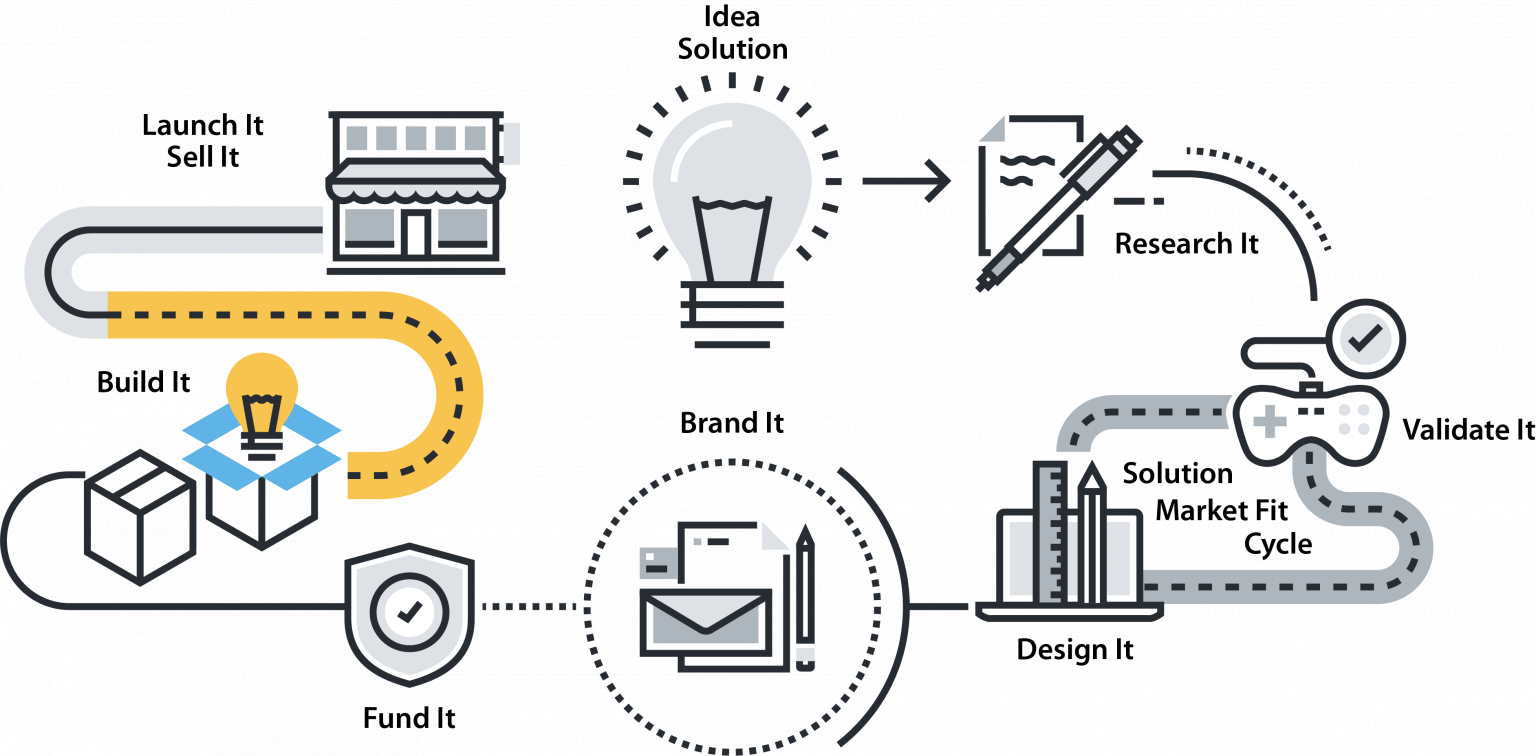

Build Something

IDEA / SOLUTION

THE INITIAL SOLUTION

How do I start to organize my thoughts around my potential business?

Use a framework to get your initial thoughts out of your head and onto paper where you can start sharing it with others. A whiteboard or empty wall with post-it notes is a great alternative to an electronic document. Many frameworks exist, the key is finding the right framework for you. We have listed below the most common three. Check out our Toolkit for others, if you want to explore your options.

- Get your initial thoughts into a framework. You do not have to complete the framework, just get your initial thoughts into it.

- Get up to speed on what is happening in your local entrepreneurial community and trends in the start-up world relevant to your type of business - Main Street, Micro-enterprise "Side Hustle", Research Based "Innovation", or Second Stage "Existing business poised for a second growth stage".

- Grow Yourself. Start Learning your Strengths and Your Weaknesses

- Adopt a Growth Mindset. Your first idea/s may fail. Most successful entrepreneurs fail SEVERAL times before launching a successful business. But they will all tell you that it was part of the process. Don't give up. Your goal is to fail quickly and cheaply and use what you learn to launch your next idea.

Your Business/Your Product

- Business Model Canvas

- Lean Canvas

- Traditional Business Plan(s)

- Get Connected: Sparkyard (Local to DFW)

- Do not spend any money.

- Do not incorporate.

- Do not pay for a logo and slick marketing materials.

- Do not spend money until you know more about your potential solution.

- Do not give up if the first idea/product/business fails

RESEARCH IT

SOLUTION FEASIBILITY

Can my solution be profitable and what/who do I need to develop & implement my solution?

fea·si·bil·i·ty | noun | the state or degree of being easily or conveniently done.

Researching and validating your solution are the two most critical aspects of a startups potential success. You are expected to be an expert on your solution and be very informed on industry trends. Secondly, you need to define what skills are needed to provide your solution to your potential customers. Many entrepreneurs routinely skip over thoroughly researching their solution, the industry, and the competitors because they are eager to get started building their solution. However, it generally leads to the problem identified below. A solution no customers want.

CB Insights did a study of 101 start-ups asking the founders and investors why those companies failed. They categorized the results into 20 aspects. The #1 reason: 43% of those surveyed cited "No Market Need" for the solution those companies built. The #3 Reason: 23% of those surveyed indicated the companies did not have the right team in place to implement.

The key learning is do your homework and become the expert people will expect you to be. For some who are industry insiders this might take you a matter of weeks. Yet, for those that are creating solutions to enter a market or industry they are not familiar with it could take months.

- Complete a financial analysis that tests if the company can make money and how long it will take to become profitable.

- Determine what core skills your company will need in the early stages and if you have the right people involved to fill those skill needs.

- Document and map out everything you can about the industry, competitors, and the specific market using your chosen framework(s).

- Problem Statement Canvas

- SBDC - Analytics Platform (Coming Soon)

- Spread Sheets - Financial Analysis

- Google Advanced Search

- Do not skip this phase.

- Do not relay on untested assumptions.

- Do not hire someone to do this research.

- Do not create an investor pitch deck.

- Do not seek investment for your startup to build a prototype.

VALIDATE IT

RUN EXPERIMENTS

How can I test the market without building an actual functioning product or service?

vi·a·bil·i·ty | noun | ability to work successfully.

This is the most misunderstood phase of building a successful startup. You want to prove your assumptions and get early feedback on the strength and importance of your solution. Chances are as a early founder you have heard the term MVP "Minimum Viable Product". Many would argue, and we at Accelerate DFW agree, that "product" should be taken out of this term. Your MVP does not have to be a minimum product or the minimum services at all. You simply need something that helps you demonstrate your solution so you can receive feedback from potential customers about your solution. As stated before, the biggest reason startups fail is because they build something no one really wants.

Validate, Validate, Validate... There are two (2) aspects of your solution that you need to validate with your potential customers.

- The priority of the problem in the customers overall daily / weekly activity.

- The interest in the solution that you are wanting to offer.

- Gather enough feedback to confidently gauge the level of problem importance & the demand for the solution.

- Gather feedback and idea for potential pivots to your solution or other applications for your solution.

- Determine your ideal target customer profiles for early adoption of your solution.

- Minimum Viable Product Template: Cheat Sheet

- Pain Point Experiment

- Solution Experiment

- Customer Validation - What Do You Ask, with Justin Wilcox

- The Lean Startup: Build-Measure-Learn Feedback Loop

- Survey Tools

- Example: Zappos, Dropbox, Buffer

- Betalist Examples

- Do not build a "lite" version of your product or service.

- Do not build your app / website or prototype.

- Do not pay someone to build your app / website or prototype.

- Do not "sell" your solution.

This is where most entrepreneurs make their biggest mistakes. They start with the next section, Design It, before they have validated the idea, the problem and the solution. The #1 reason startups fail: 43% of those surveyed cited "No Market Need" for the solution those companies built. Avoid this mistake, validate with your potential customers before you build anything!

Stage-Gate: Go / No Go

DESIGN IT

PLAN YOUR COMPANY

What are the important aspects / features of my solution that potential customers care most about?

This is where you start to make some important decisions about your product and your company. Many of successful startups have built their initial product / service in a way that they knew they would have to start over for version 2. Why would they do this? Because it is what they could build quickly and cost effectively. The product driving forces for this phase are designing for speed to market and maximizing customer value with only the most essential aspects / features. Great entrepreneurs are able to really show their stuff here, as they are resourceful!

Building Your Team

In this phase you will decide if you are going to be a solopreneur, a micro-enterprise or if you need to build a founding team. Many main street businesses have a single founder and need employees. An office manager or store manager is a great opportunity to recruit someone with skills you don't have to strengthen the capabilities of your company. During the initial Idea Phase you took a few personality and skill tests. Now is the time to compliment your skills with others. If you know you need to have a founding team them you need to start looking for potential co-founders while you network and explore the world of startups. Founders rarely have all the skills needed to build both the product/service and the business. If you are a solopreneur, one founder/owner, then think about what skills you need to hire out. However, when it comes to your product / service you should be making it yourself as apposed to hiring an outside firm to build your product for you. Building a company means building a team. Highly effective teams create value way beyond just the product or service. Start recruiting to fill the skill gaps.

- Create your initial product roadmap.

- Bring on co-founders, key team members.

- Incorporate your business.

Product

- WordPress

- Raspberry Pi / Arduino Boards

- Maker Community

- Sketch-Up

- Y-Combinator - Startup School

- Customer Feedback Process

Team

- Defining the teams skill sets

- Co-founder Meetups / groups / platforms

- DISC Skill Set Analysis

- 16 Personalities Strength/Weakness Analysis

- StrengthsFinder Analysis

- Background Checks

- Do not "feature pack" your solution.

- Do not trust your instincts, verify peoples skills / backgrounds.

- Do not stop networking.

- Do not outsource your product or service.

BRAND IT/MARKET IT

SOLUTION PACKAGING

What impression do I want to give to my ideal customer base?

Customers tell you everything you need to know about how to sell to them, what to sell to them and how it should be priced, if you gave them ample opportunity to do so during the validation stages. If you are struggling here to determine what to say and why you are saying it then revisit your validation data or go get more validation from potential customers.

Marketing is the quintessential example of going down a rabbit hole. For instance, have you ever wondered why so many company logos are blue? All colors convey a non-verbal message, an emotional response. First off, it always ranks as the most universally liked color. Secondly, it conveys the emotions of creativity, safety / serenity, trust, dependability, and is associated with intelligence. It makes for a great logo color when customer loyalty is a key business factor. (How AccelerateDFW chose it's new brand color).

Short Term Critical Success Factors: When thinking about how much marketing effort to take on and how far down the rabbit hole you go think about what your short term business goals are. Create your marketing plan based on only these goals.

- Determine your company vision, mission statement, and values.

- Create your brand, the perception you want to convey in the eyes of the customer.

- Create your strategic marketing plan. (Business Goals, Marketing Goals, Target Customer Profiles, & Campaigns) (Be-aware: You will find a lot of confusion and contradiction about these subjects. Strategic Marketing vs Tactical Marketing. Campaign vs Advert. Marketing is messy.

- Lean Canvas - Unique Value Prop, Customer Segments, Channels

- Smart Goals

- Canva

- Logo Maker Tool

- Explainer Videos

- Don't adopt an "everything but the kitchen sink" approach.

- Do not start with tactics. For example: Facebook / Google Advertising.

- Do not try to market to everyone, thus targeting no one.

FUND IT / PROTECT IT

THE INITIAL SOLUTION

What kind of funding does my company need?

It does not matter if your are a main street business, a micro-enterprise or a tech startup, working capital is essential. However, you might be surprised to find out how most startups fund their endeavors, (Where startups get their funding). The most common misunderstanding in the startup world is when investors are interested in investing in a company. Spoiler: it is not in the early days of an idea with no prototype or validation that a sufficient market exists for a solution. Funding comes from many places, these are the most common: Founder savings, founder credit cards, friends & family, bank loan(s), grants, VC / angel investors, competitions and bootstrapping (organic via sales).

How do I protect my solution / company?

If you have true IP or a patent-able innovation then great. However, most companies do not have anything unique in these aspects. So the obvious question is how do they build their companies? Most companies these days take an off the shelf product / service and add a twist. A unique aspect that targets a specific audience that is currently not served or is undeserved. They then fortify this with, for example, a strong brand presence or by building a partner, supplier network that is hard to replicate. There are many other ways to defend your business.

- Create your pitch deck.

- Create your business plan, for bankable companies.

- Bring on co-founders, key team members.

- Incorporate your business.

- Gain traction with customers / potential customers.

- Crafting an Investor Pitch

- Term Sheets

- What to know about VC funding

- Bootstrap

- Do not ask VC's to fund an idea.

- Do not be scared to tell people what you are working on for fear they will steal it.

- Do not rely on one type of funding pathway.

- Do not forget to "shop" patent attorney prices.

BUILD IT

BUILD YOUR SOLUTION

What do I need to build my product or service as quickly as possible?

In this phase you start building your physical product, service, main street business, SAAS platform, or what ever form your solution takes. In this phase time and perfection are not your friends. Many entrepreneurs get stuck here, constantly tinkering and never making it to the next phase, launch. You might need to make new relationships with potential suppliers or people who will deliver your service. You might have to learn some new skills or make some compromises on your dream product or service. This is your doing phase, talkers get left in the dust.

Keep in mind that the best companies approach this process as designing a feedback loop. Release, get feedback from customers, alter and release again, get feedback from customers, etc... The goal is to find the strongest product market fit as fast as possible.

- Get version alpha in the hands of your potential customers.

- Create an iterative product / service improvement process.

- Do not seek perfection.

- Do not be scared to tell people your solution.

- Do not hibernate while building, keep networking.

LAUNCH IT / SELL IT

SET YOUR SOLUTION FREE

What is the ideal way to introduce my solution to my potential customers?

This is where the rubber meets the road, getting a customer to pay for your solution. For those that have diligently done their research and validated their assumptions with potential customers, selling will be much easier. For those that simply built their solution and launched, this process might be painful. This is where you put your marketing plan to work. Align how you have segmented the market with a target customer profile and talk about your features / benefits and points of differentiation, simple as that. The hard part is getting to a point where you can talk to customers. For business to business sales it is usually compiling and working a list with sales calls, e-mails and networking. For business to consumers it is usually building product awareness, providing demos of the product and having a rewards program for referrals.

- Get version alpha in the hands of your potential customers.

- Create an iterative product / service improvement process.

- Product Launch Plan

- Marketing & Sales Funnel

- Crafting a Sales Pitch

- Marketing & Sales CRM's

- Do not give up.

- Do not forget to get continuous feedback from your customers.

- Do not think VC/Angel funding for mass marketing is the ticket.